CBAM warrants steel exporter reaction

Steel exporters will need a robust response following the European Union’s new carbon border tax, which will be valid from October.

31/08/2023 12:53

The European Commission adopted the Carbon Border Adjustment Mechanism (CBAM) on August 17 after two years of negotiations. The new regulatory framework will have far-reaching consequences for non-EU producers and importers, notably in the iron, steel, aluminium, cement, fertilisers, and hydrogen sectors, which are particularly sensitive to carbon leakage.

CBAM warrants steel exporter reaction, illustration photo/ Source: freepik.com

CBAM warrants steel exporter reaction, illustration photo/ Source: freepik.com

Under the new rules, companies will face penalties of up to $55 per tonne of carbon emissions if they fail to comply with reporting requirements from October. From 2026, the tax will apply to items made of high-carbon materials.

The first 18 months will allow EU member states time to implement new policies to enforce CBAM requirements. Variation will be permitted throughout the trial period, but a unified EU norm will take effect in 2025.

South Korean steel enterprise Posco believes that becoming carbon-neutral will not be easy. In fact, if carbon emissions are not reduced, it will be difficult to achieve competitiveness due to the increase in product prices due to tariffs.

At a conference on the issue in Hanoi in July, a representative of Posco Group said, “I went to Europe five times last year to talk about this issue. The EU also said that there are still some issues related to the mechanism. However, they are still resolute with the roadmap.”

Steel enterprises, including those from Vietnam, must comply with the reporting regime. “This will be a trade barrier for the steel industry, requiring businesses to have a common voice to go further and respond to the mechanism,” he added.

Dinh Quoc Thai, general secretary of the Vietnam Steel Association (VSA), said that if steel enterprises do not respond well to the CBAM, the volume of exports to the EU and the two-way trade in steel with the EU will be affected.

“What is the most dangerous is losing more other markets when these countries are also considering applying similar regulations to the CBAM. The need to comply with it cannot be delayed, and steel exporters to Europe must master it in order to properly apply it and not be violated,” he warned.

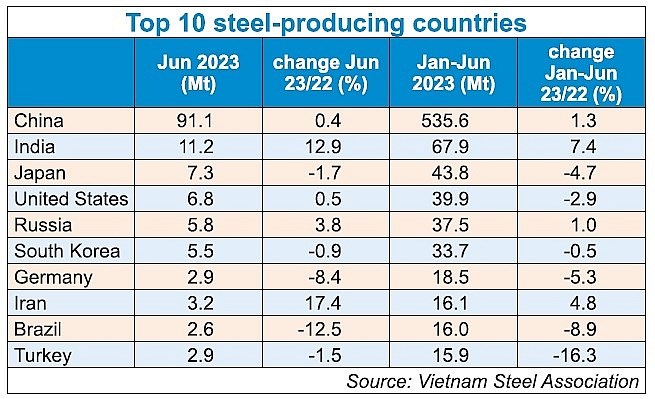

In the first six months of this year, Vietnam’s trade surplus of goods to the EU was estimated at $14.5 billion, down 9.8 per cent over the same period last year.

However, among them, steel export reached 1.36 million tonnes with export turnover reaching about $1 billion, an increase of 1.5 times compared to the same period in 2022 and a slight decrease in export value, according to the VSA.

The CBAM will also be a burden for Vietnamese steelmakers when exporting to the EU due to a lack of domestic carbon pricing, and also for steel producers to accelerate the decarbonisation of their operations.

Vietnam plans to pilot a carbon trade exchange by 2025, which will be officially operating by 2028.

“In 2028, the official carbon credit exchange will be organised to operate, regulating activities to connect and exchange domestic carbon credits with the regional and global carbon markets. This will be a test for Vietnamese businesses in reducing greenhouse gas emissions,” said Pham Van Tan, deputy director of the Department of Climate Change under the Ministry of Natural Resources and Environment.

According to the roadmap, enterprises in the list of large emitters are also required to develop emission reduction plans from 2026 onwards. During the pilot phase, major emitters such as steel, thermal power, solid waste management, and cement production will be tasked with inventorying emissions according to the list promulgated by the prime minister.

By Nha Phuong (vir.com.vn)